28+ paycheck calculator montana

Supports hourly salary income and multiple pay frequencies. Web By using Netchexs Montana paycheck calculator discover in just a few steps what your anticipated paycheck will look like.

Hourly Paycheck Calculator Nevada State Bank

Ad Get the Paycheck Tools your competitors are already using - Start Now.

. Web Montana Salary Paycheck Calculator. Web Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator. Your average tax rate is 1167 and your marginal tax rate is.

Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Montana. Web What is the income tax rate in Montana. Your average tax rate is 1929 and your.

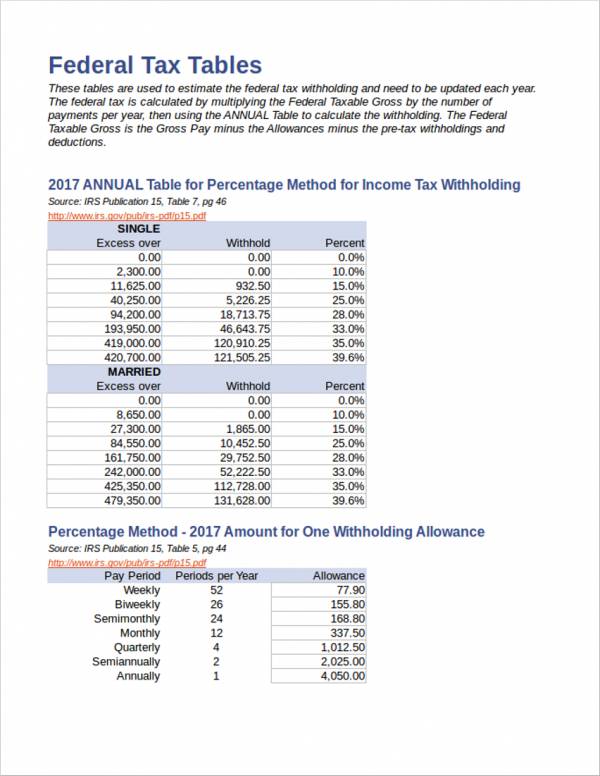

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The state income tax rate in Montana is progressive and ranges from 1 to 675 while federal income tax rates range from 10. Montana Paycheck Calculator Frequently Asked.

Web Use ADPs Montana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Calculating paychecks and need some help. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Just enter the wages tax withholdings and other. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Figure out your filing status work out your adjusted. If you make 182500 a year living in the region of Montana USA you will be taxed 47296.

Last Updated on February 21 2023 This calculator is used to determine Montanas paychecks. Web Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Simply enter their federal and state W.

Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Web Montana Income Tax Calculator 2021. Web Montana MT State Payroll Taxes for 2023 Now that were done with federal payroll taxes lets look at Montanas state income taxes.

Web Paycheck Calculator Montana - MT Tax Year 2023. Web Montana Income Tax Calculator 2022-2023 If you make 70000 a year living in Montana you will be taxed 11822.

Energy Just Facts

Pdf Ningaloo Collaboration Cluster Socio Economics Of Tourism

Montana Wage Calculator Minimum Wage Org

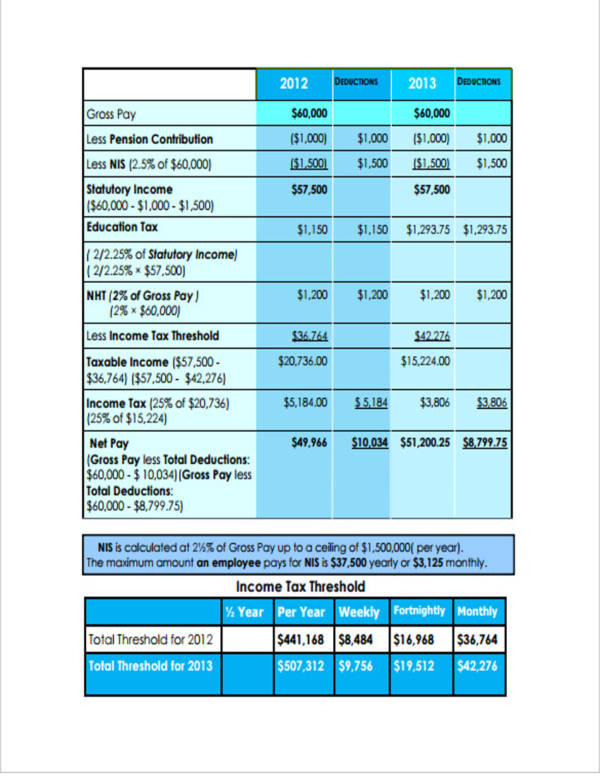

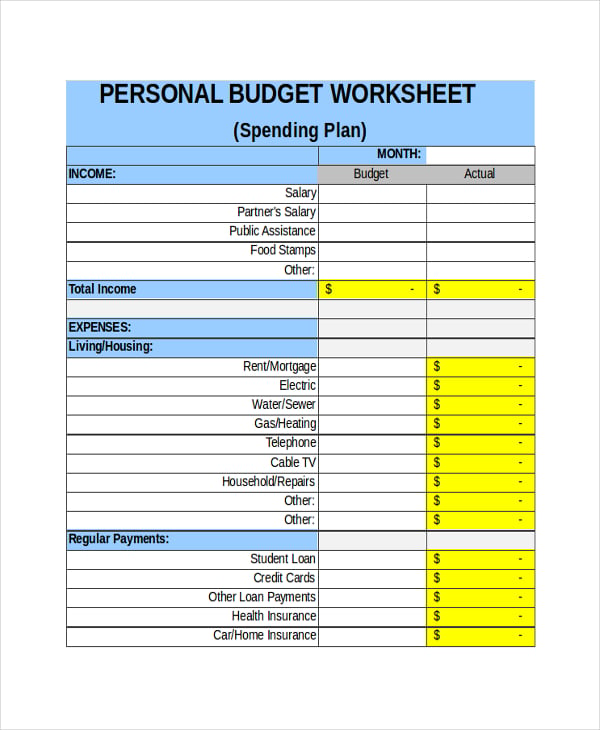

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Tip Tax Calculator Primepay

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

28 Sample Budget Marketing Plan In Pdf

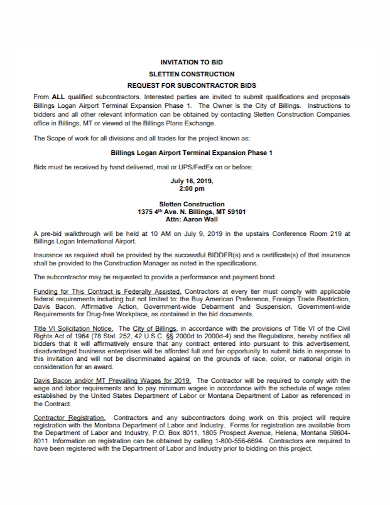

Free 10 Subcontractor Bid Samples In Pdf Doc

Basics Of Corn Production In North Dakota Ndsu Agriculture And Extension

Nitro Scrambler Rucksack 28 L Nitrobags Shop

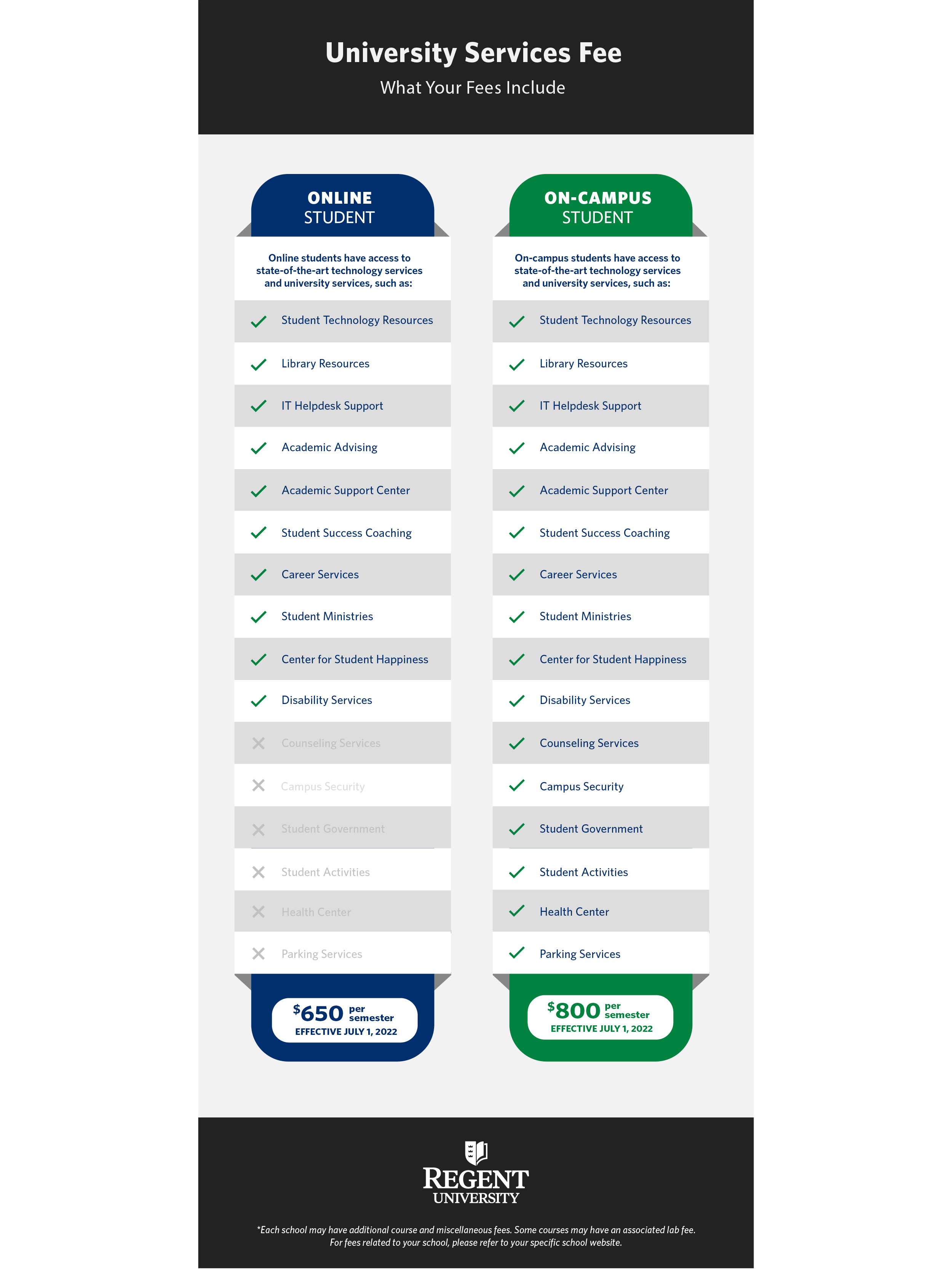

Scholarships For On Campus Undergraduate Students Regent University

Energy Just Facts

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

33 Sheet Templates Free Sample Example Format

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Scholarships For College Freshmen Regent University